Introduction

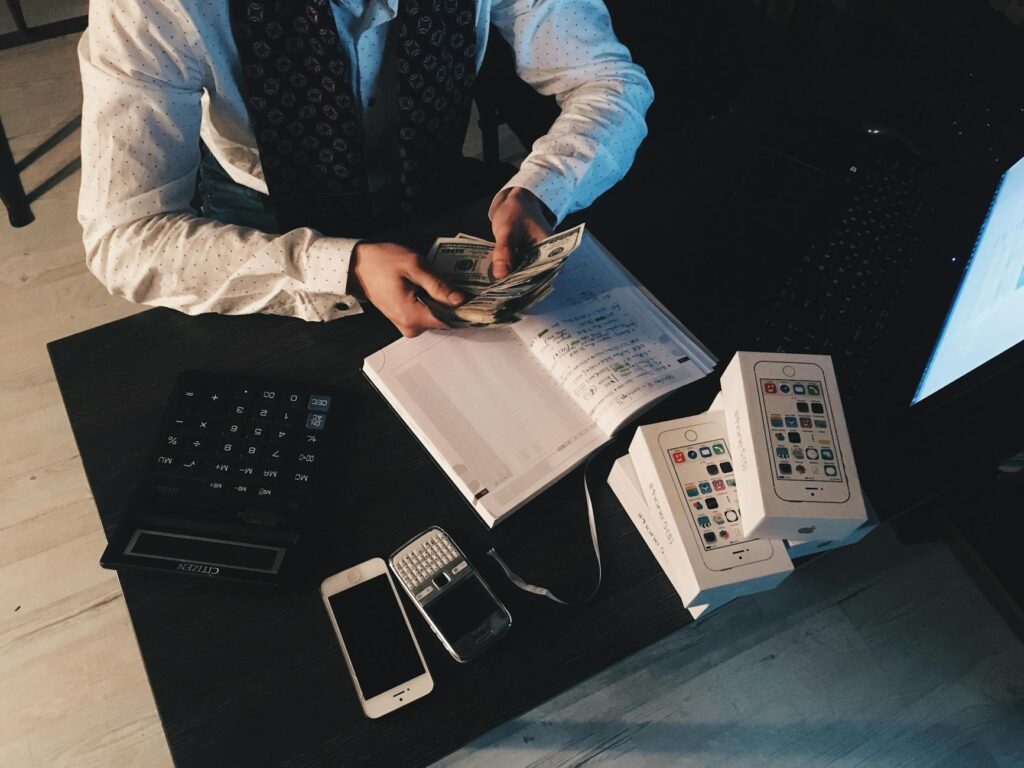

Taking control of your finances can feel daunting, but it doesn’t have to be! Budgeting and effective money management are essential life skills that can lead to financial freedom and peace of mind. This guide will walk you through practical strategies to help you manage your money more effectively.

Creating a Realistic Budget

The foundation of successful money management is a well-defined budget. Start by tracking your income and expenses for a month to understand where your money is currently going. There are many budgeting apps available to help, such as Mint or Personal Capital. Check out this budgeting app comparison to find one that suits you. Once you have a clear picture, categorize your spending (housing, food, transportation, entertainment, etc.) and identify areas where you can cut back.  Remember, your budget should be realistic and adaptable to your lifestyle.

Remember, your budget should be realistic and adaptable to your lifestyle.

Setting Financial Goals

Having clear financial goals is crucial for staying motivated. These could be short-term goals like paying off a credit card or saving for a vacation, or long-term goals like buying a house or securing your retirement. Breaking down large goals into smaller, manageable steps makes them less overwhelming. For example, if you’re saving for a down payment, set monthly savings targets. Learn more about setting SMART financial goals.

Managing Debt Effectively

High levels of debt can significantly impact your financial health. If you have outstanding debt, develop a strategy to tackle it. Consider strategies like the debt snowball method or the debt avalanche method, depending on your preferences. Here’s a helpful resource on debt management strategies. Prioritize paying down high-interest debt first, to minimize the total interest paid.

Building an Emergency Fund

An emergency fund is a crucial safety net for unexpected expenses, such as medical bills or car repairs. Aim to save 3-6 months’ worth of living expenses in a readily accessible account. This will prevent you from going into debt when faced with unforeseen circumstances. Discover more tips on building a strong emergency fund.

Investing for the Future

Investing your money can help it grow over time, enabling you to achieve your long-term financial goals. There are various investment options to consider, such as stocks, bonds, and real estate. It’s essential to research and understand the risks associated with each investment type before making any decisions. Consult with a financial advisor for personalized advice. [IMAGE_3_HERE] Learn more about diversification in investing.

Conclusion

Mastering budgeting and money management is a journey, not a destination. By consistently implementing these strategies and adapting them to your circumstances, you can gain control of your finances, reduce stress, and build a secure financial future. Remember, consistency and discipline are key to long-term success. Check out our budgeting worksheet!

Frequently Asked Questions

What is the best budgeting method? There’s no one-size-fits-all answer. Experiment with different methods (50/30/20, zero-based budgeting, etc.) to find what works best for you.

How much should I save each month? The amount you should save depends on your individual financial goals and circumstances. A good starting point is to save at least 10-20% of your income.

What if I can’t stick to my budget? Don’t get discouraged! Review your budget regularly, identify areas for improvement, and adjust your spending habits as needed.

How can I track my spending effectively? Use budgeting apps, spreadsheets, or even a simple notebook to monitor your income and expenses.

When should I seek professional financial advice? Consider seeking professional help when you’re facing complex financial challenges, such as significant debt or major investment decisions.