Understanding Commercial Auto Insurance

Protecting your business and employees on the road is crucial. Commercial auto insurance is designed to cover vehicles used for business purposes, offering liability and physical damage coverage. It’s not just about complying with the law; it’s about safeguarding your financial future.

Types of Commercial Auto Coverage

Several types of coverage exist to fit your specific needs. Liability coverage protects you against claims if you cause an accident. Collision coverage pays for repairs to your vehicle regardless of fault. Comprehensive coverage handles damage from non-accidents, such as theft or vandalism. You can also consider uninsured/underinsured motorist coverage for added protection. Choosing the right combination is key, and talking to an insurance professional can help you find the best fit for your business, like whether you need coverage for non-owned vehicles, learn more about additional coverage options here.

Factors Affecting Your Premium

Several factors influence your commercial auto insurance premium. Your driving record plays a significant role; a clean record typically results in lower premiums. The type of vehicle you use impacts costs; larger vehicles often have higher premiums. Your business’s operational details are also important: high-mileage businesses might face higher premiums. Check out this guide to better understand the specific factors influencing premium rates in your state.

The Claims Process

If you’re involved in an accident, reporting the claim promptly is crucial. Your insurance provider will guide you through the steps. Gathering information at the accident scene, such as contact details and police reports, is important. Accurate documentation helps to speed up the claims process and ensure a fair settlement. Keep detailed records of all communication with your insurer. Read our step-by-step guide on filing a claim.

Managing Your Policy

Regularly reviewing your policy ensures it aligns with your business’s evolving needs. As your business grows or changes, your insurance needs may change as well. Consider adding coverage for new vehicles or employees.  Proactive policy management reduces potential risks. Staying informed about policy updates and industry changes is essential. You can also explore discounts and ways to save on your premium.

Proactive policy management reduces potential risks. Staying informed about policy updates and industry changes is essential. You can also explore discounts and ways to save on your premium.

Choosing the Right Provider

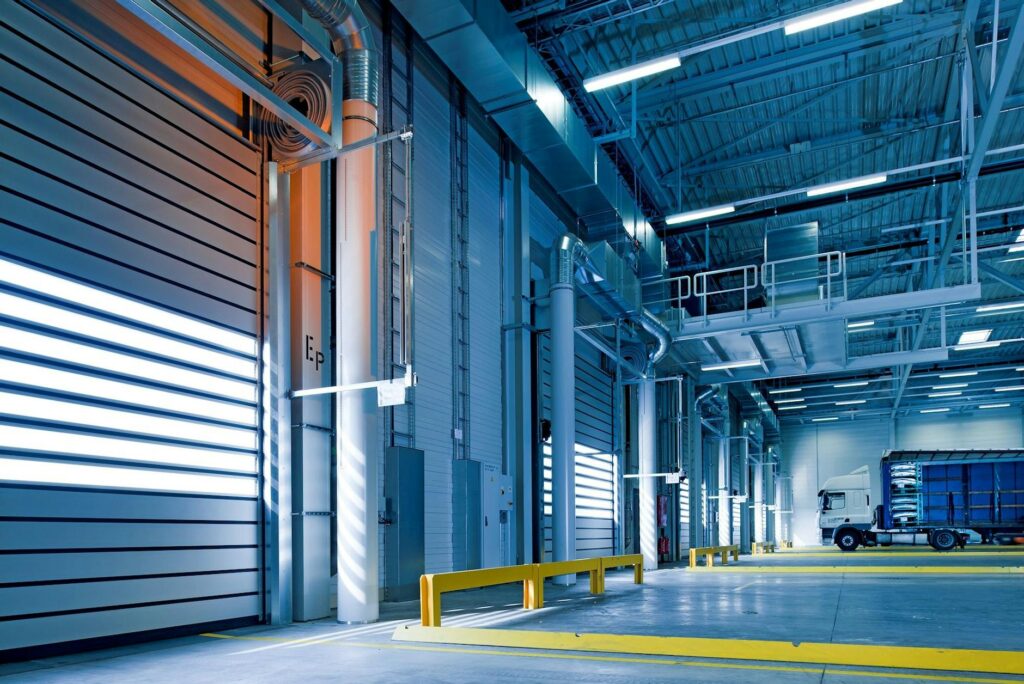

Selecting a reputable insurance provider is crucial. Consider factors like financial stability, customer service ratings, and coverage options offered. Compare quotes from multiple providers to find the best value. Reading reviews from other business owners can provide valuable insights. Don’t hesitate to ask questions and ensure you fully understand the terms and conditions before committing to a policy. Use this comparison tool to find a suitable provider for your business needs. [IMAGE_3_HERE]

Conclusion

Commercial auto insurance offers crucial protection for your business. By understanding the different types of coverage, factors affecting premiums, and the claims process, you can make informed decisions to secure your business’s assets and financial well-being. Remember, regular review and proactive management of your policy are crucial for ensuring ongoing protection.

Frequently Asked Questions

What types of vehicles are covered under commercial auto insurance? Commercial auto insurance covers a wide range of vehicles used for business purposes, including cars, vans, trucks, and motorcycles. Specific coverage depends on your policy.

How do I get a quote for commercial auto insurance? You can get a quote by contacting insurance providers directly or using online comparison tools. Be prepared to provide information about your business, vehicles, and driving history.

What happens if I am involved in an accident? If you are involved in an accident, report it to your insurance provider immediately. Gather necessary information at the scene and follow their guidance on the claims process.

Can I bundle my commercial auto insurance with other business insurance policies? Many providers offer discounts when you bundle multiple policies, such as commercial auto and general liability insurance. Find out more here.

What if I need additional coverage? If your business needs expand, for example, you add more vehicles or hire more drivers, you should adjust your policy accordingly to ensure continued and adequate coverage.